Financial News

Water the Untapped Opportunity

Published

2 years agoon

By

admin

Every time I see the film The Big Short, I’m constantly pondering the prophetic remark that appears at the conclusion of the film. “Michael Burry is concentrating all of his trading on one commodity: water.”

The film ‘The Big Short,’ based on Michael Lewis’s book ‘The Big Short: Inside the Doomsday Machine,’ is about investors who predicted the credit and housing bubble collapse in 2008 and entered into trading activity to take advantage of their prediction, earning billions of dollars as a result. Dr. Michael Burry, who is portrayed by Christian Bale in The Big Short, is a real-life hedge fund manager who did just that.

Since the film’s release, Burry has become increasingly vocal about his investment views on water. Here is where my wheels started turning on the issue of water. Why is it that one of the few analysts and traders to correctly predict the housing bubble burst in 2008, and who made a good profit from that prediction, now focuses all of his attention on water? What can he possibly see when he thinks about it, and how can I get involved?

First and foremost, H2O is essential for life.

Every single person on this planet needs water to survive, which makes it a very valuable commodity. There are only a finite amount of freshwater resources available, and with the world’s population continuing to grow, the demand for water is only going to increase. I’m talking about the same guy that was correct on the 2008 financial crisis, so there must be something to back up his interest in water. This individual made billions by shorting the Subprime Loan market, so what kind of return or profit can he anticipate from investing in H2O? And this is where the heart of the issue lies: how can I get involved?

A few ways to get involved in water as an investment are:

-invest in companies that specialize in H2O treatment or transportation

-buy shares of utilities companies

-look for exchange-traded funds (ETFs) that focus on water-related investments.

While these are all great methods, the better approach to this investment technique would be to hear what Dr. Michael Burry has to say on the subject himself. “I think agricultural land, particularly fertile farmland with access to water, will be quite valuable in the future,” he stated in a 2010 interview with Bloomberg. He also said that “Fresh, clean water is going to become increasingly scarce, and I think its value will continue to go up.”

So there you have it, coming from the man himself. Dr. Michael Burry is investing in H2O because he believes that it will become an increasingly valuable commodity

as time goes on due to the finite nature of freshwater resources. Water is political and litigious. “Water transportation is impossible because of both political and physical factors, so acquiring water rights didn’t make much sense to me unless I was pursuing a greater fool theory of investment; which was not my objective. What became apparent to me is that food is the most effective way to invest in water ……. With this method, it is possible to grow food in water-rich regions and transport it for sale in water-poor areas. This is the most peaceful way of distributing water, and it can be profitable over time, ensuring that this redistribution is permanent. A bottle of wine requires around 400 bottles of water to produce.”* Burry has found the H2O that is contained within food to be a new form of investment opportunity.

*https://greenbackd.com/2010/09/08/bloomberg-on-burry/

I never considered H2O from this viewpoint, and I’m sure that many of you never have either.

What I like about this approach is that it isn’t linked to a particular financial instrument such as a stock, ETF, or ETP. There isn’t any need for a chart to illustrate an intricate formula to deconstruct this fundamental truth: take water, grow food, and sell it in areas where H2O is scarce. Of course, there are always going to be inherent risks with any investment, and this is no different. Droughts can occur, which will obviously have an adverse effect on crop yields. Also, the price of oil can play a role in the cost of transporting food to water-scarce areas.

Investing in H2O is a unique opportunity,

and I think it’s one that is definitely worth considering. It’s an investment that can have a positive impact on the world, and it’s something that we all need to survive. Dr. Burry’s idea may provide and preserve wealth for people seeking alternative assets. The majority of the Earth’s surface is covered in water, with 70 percent of it being freshwater. 2.5% of the world’s water is used to grow crops and produce food that we consume. Furthermore, only 1% of freshwater is readily available because the other 99% is stored in glaciers and snowfields. That leaves approximately 0.007 percent of the planet’s water for 7 billion people to utilize.

According to the United Nations, water usage has increased by over twice the rate of global population growth in the last century. We use about 30% of the planet’s total available renewable supply of H2O. The U.N. predicts that, in just a few years, this percentage will be 70%. By 2025, 1.8 billion people will live in water-scarce areas, with two-thirds of the globe’s population living in water-stressed locations. According to a report from The American Society of Civil Engineers (ASCE), by 2020, there will be a $84.4 billion deficit in funding for water infrastructure growth. The report also states that by 2040, this number will rise to $106.5 billion.

This pattern offers the potential of investment possibilities in firms involved in the following sectors,

improving water supply. Activities such as water exploration, desalination, and wastewater treatment are included on the list. Firms which focus on H2O efficiency, such as those that make drought-resistant seeds or irrigation technology, are also interesting. And finally, firms that distribute and trade H2O can take advantage of pricing disparities around the globe.

If you can’t afford to buy lush farmland with H2O on site near the Amazonian rainforest but still want to participate in the activities listed above, investing in firms engaged in these industries might be an option for you. SJW Corp. (SJW), Middlesex Water Co. (MSEX), and York Water Co. (YORW) are water utilities that focus on providing clean water to their customers. Aqua America, Inc. (WTR) is another water utility with a nationwide reach. Calgon Carbon Corporation (CCC), Nalco Holding Company (NLC), and Severn Trent plc (SVTLY) all engage in water treatment activities.

SJW is a conglomerate with four branches: San Jose Water Company, SJW Land Company, SJWTX Inc., and Texas Water Alliance Limited. The companies have an interest in developing new H20 projects as well as acquiring and developing land.

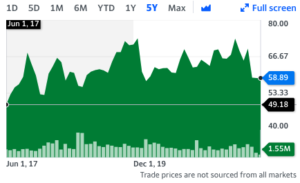

SJW

Chart courtesy of yahoo 5/9/22

MSEX is a water and wastewater utility provider for municipalities and private clients in New Jersey and Delaware.

Middlesex Water Company (MSEX)

These stocks have shown consistent and substantial gains over the previous five years, suggesting that they may be sleeping giants. If the commodity of water keeps on growing in secondary industries, Dr. Burry’s prospects and fortune-hunting enterprises involving H2O have a chance of coming true in the same way as his bet on the collapse of the subprime loan market.

Read More Financial News Here

You may like

Still has momentum.

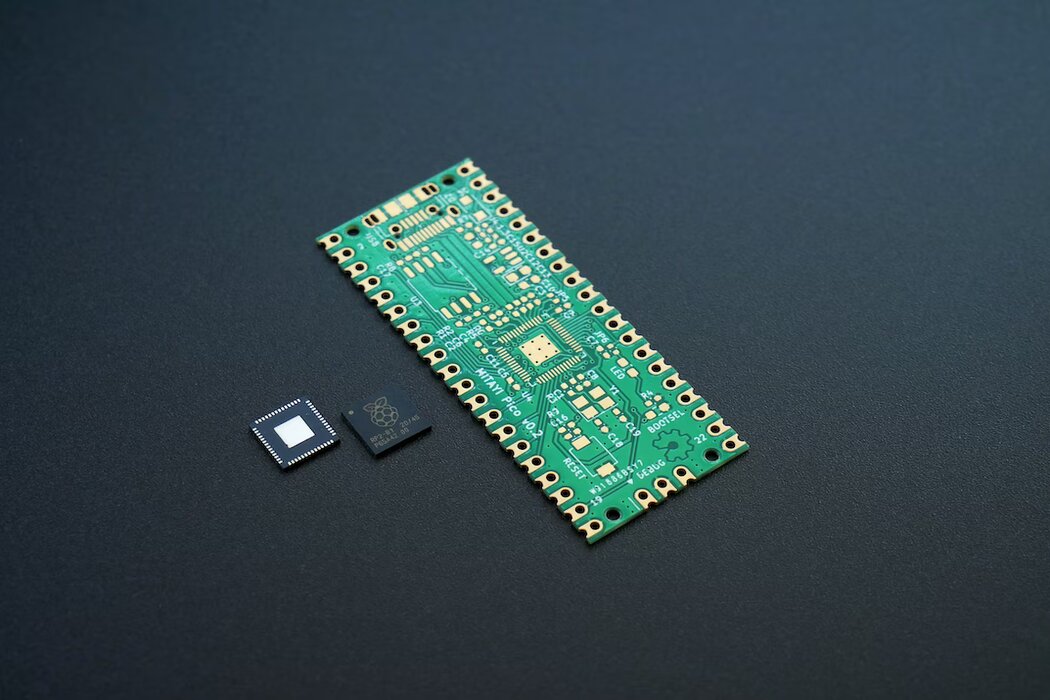

We still issue a buy rating on the Taiwan Semiconductor Manufacturing Company (NYSE: TSM). Our optimistic outlook on TSMC is based on our belief that the firm is better positioned to outperform now, as the semiconductor industry slowly but steadily improves and the company accounts for lower demand in FY2023. TSMC’s fourth-quarter earnings reports were mixed; the company beat profitability projections but fell short on sales. Despite this, the stock climbed roughly 5% when earnings were released. We believe TSM is attempting to counteract reduced end-market demand and inventory corrections, which have hurt sales and lowered forecasts for the upcoming quarter. It is likely that a bottom in TSM and the semi-space in 1H23, followed by a significant recovery in the year’s second half.

We feel that TSM’s stock is a good entry place before the semi-space rebounds. Since our last post on TSMC in late October, the company has already gained 41%, surpassing the SOX index, which has gained only 21%. The graph below depicts our rating history for TSMC.

We urge that investors disregard the market hype surrounding fears of a Chinese invasion of Taiwan and instead focus on the company’s industry-first approach. We believe that TSMC is best positioned to benefit from chip demand once the semiconductor market recovers. Furthermore, we anticipate the company will have the additional power to raise ASP in the second half of 2023. We recommend that investors purchase the stock at current levels in order to benefit from TSM’s rising growth trend in 2023.

The leading pure foundry space allows for ASP gains.

We favor TSMC’s position in the foundry industry, with a 60% market share in 4Q22, and expect it to boost ASP on advanced nodes. We predict TSMC’s market share will expand significantly in 2022 as a result of the increased manufacture of smaller, more sophisticated 5nm wafers. Nanometer size is at the heart of technical developments in the semiconductor industry and, by extension, the world. To be more specific, nanoscale size refers to the distance between transistors on a chip; the smaller the chip, the more advanced and high-performing it is. Our positive outlook on TSM is predicated on our expectation that the company’s growth would be driven by increased adoption of advanced nodes, which are gradually accounting for a larger portion of TSMC’s revenue by technology. TSM has also begun the manufacture of 3nm processors for Apple (AAPL), sustaining Moore’s Law and looking ahead to next-generation technologies.

We anticipate that the rising global adoption of advanced nodes to meet the surging demand for semiconductors will fuel TSMC’s medium- to long-term growth. As a result, we anticipate that TSMC’s position will allow it to improve ASP on advanced nodes in 2H23, owing to the fact that it retains big semi-players as top clients, including Nvidia (NVDA), Advanced Micro Devices (AMD), and AAPL, among others.

Headwinds still persist

TSMC is not immune to the demand slowdown caused by macroeconomic headwinds, as seen by a dip in 1H23 followed by a fast recovery in 2H23. In Thursday’s results call, TSMC CEO C.C. Wei clarified, stating he anticipates 2023 to be a “slight growth year.” We expect TSMC will face inventory corrections in 1H23 as a result of the deteriorating chip-demand environment. We estimate CAPEX reduction in TSMC during 2023, largely as major client AAPL forecasts reduced demand despite weaker consumer spending. TSMC management warned that revenue would fall by roughly 5% in 1Q23, and that annual spending would be reduced. TSMC announced a CAPEX of $36.3B in 2022 and expects CAPEX to be $32-36B in 2023. We are not concerned by TSMC’s lower 1Q23 prediction because we believe the firm is de-risking guidance due to the challenging macro environment.

Despite the macroeconomic challenges, we expect TSMC to continue growing its foundry operations outside of Taiwan in order to mitigate the risks of geographically concentrating manufacturing on the disputed Island. We believe TSMC will play a larger role in the global shift to manufacturing chips in the United States after the CHIPS Act is implemented in 2022. The business intends to more than increase its investment in US foundries to $40 billion by 2026, establishing the US as a hub for advanced chip manufacturing. We estimate that it will take three to four years for US semiconductor companies Intel (INTC) and TSMC to meaningfully produce chips on US territory. Nonetheless, we anticipate that TSMC’s US fabs will be a long-term growth driver.

We predict TSMC stock to rise in the second half of 2019 as the semiconductor sector recovers from a 15-month slump. We anticipate that product introductions and expanded manufacturing of 5nm wafers will help the semiconductor industry recover.

Valuation

We feel TSMC is a value investment since it is selling at a discount to its peer group average. The company is trading at 14.4x C2023 P/E, compared to the peer group average of 21.9x. The company is currently selling at 0.2x EV/C2023 Sales, compared to the peer group average of 4.8x. We believe TSMC stock offers an appealing entry point at current levels, and that investors who purchase the stock now will be well rewarded in 2023.

What should be done with the stock?

We remain optimistic about TSMC. We believe the stock is reacting to lower chip demand in 2023. While we expect the stock to remain volatile in 1H23 as the semiconductor space bottoms, we believe TSMC will benefit from demand tailwinds as the semi-space recovers in 2H23. We also anticipate that TSMC’s growth will be fueled by higher 5nm production and the company’s capacity to boost ASP on advanced nodes in 2H23. We feel the stock offers a good entry point at the current price and propose that investors acquire it.

For More Financial News, Click Here.

Financial News

Solana is Coming Back to Life With a Massive Surge

Published

1 year agoon

January 17, 2023By

admin

It’s a true comeback: the triumphant return of Solana that many experts and industry insiders had written off after the bankruptcy of Sam Bankman-Fried’s FTX on November 11.

They predicted that SOL would not be able to withstand the earthquake symbolized by the collapse of the FTX cryptocurrency exchange and its sister company Alameda Research, a hedge fund that also serves as a trading platform for institutional investors.

In the crypto world, FTX and Alameda were the major corporations representing the Bankman-Fried crypto empire, abbreviated SBF.

“Sam Coin”

Solana did, in fact, have intimate ties to Bankman-Fried. Sol, also known as “Sam coin,” is a token produced by the Solana Blockchain that enables the development of decentralized finance or DeFi projects that provide financial services such as loans, mortgages, financial products, and so on.

The coin is linked to an on-chain crypto exchange dubbed project Serum, which was founded by Bankman-Fried, who resigned on November 11 when his enterprise declared bankruptcy.

Serum is one of the infrastructure’s pillars, as it is the protocol and ecosystem that enables Solana DeFi’s fast speed and low transaction cost. It provides an on-chain central limit order book and matching engine, allowing institutional and retail investors to share liquidity and use strong trading features.

It allows developers the freedom to create trading applications without limitations, as it is not tied to any specific assets. This allows them to utilize Serum’s liquidity and ecosystem advantages in their trading application.

As if to prove Cassandra correct, Sol prices plunged by 73% between the onset of FTX’s issues on November 6 and December 31.

They finished the year at $9.96, down from $32.72 on November 5.

SOL has increased by 79%.

However, as quickly as they fell, so did the prices of Sol. According to monitoring firm CoinGecko, they are up 79% in the last seven days. Sol is currently knocking on the doors of the top ten cryptocurrencies in terms of market value. Before the club’s demise, the token belonged to it.

Prices are currently trading at $23.39, a 134% increase from the beginning of the year.

After a statement of support from Vitalik Buterin, one of the most important voices in the crypto world, sentiment toward Solana shifted.

“Some clever people tell me there is a sincere brilliant developer community in Solana, and now that the nasty opportunistic money people have been washed out, the chain has a bright future,” Buterin, one of the co-founders of Ethereum, the most powerful crypto platform, wrote on Twitter on December 29.

“Hard for me to know from the outside,” he said, “but I hope the neighborhood gets a fair shot to grow.”

Short Squeeze

According to numerous industry sources, the resurrection of SOL is also attributable to an increase in demand for decentralized financial projects. The Solana blockchain enables developers to create decentralized apps, or dApps, at a low cost and provides fast transaction execution.

Its scalability, speed, and affordability make it an appealing alternative for DeFi initiatives that require significant volumes of transactions to be processed rapidly and at a cheap cost.

“While traders are cheering the return of Bitcoin (back over $21,000), and Ethereum (back over $1,550), #Solana is the real star as the weekend begins,” said Santiment, an on-chain analytics business. “$SOL has gained +22% in the last two hours alone, fuelled by liquidated shorts.”

According to Santiment, the significant comeback in Sol prices is the result of a “short squeeze,” which is a fast increase in the price of an asset caused by investors who bet against the product, being forced to purchase it in order to limit their losses.

For More Financial News, Click Here.

After reaching record lows not seen since 2016, 2022 was merciless for Alibaba Group Holding (NYSE: BABA). This comes as no surprise given all of the recent China-related news. A zero-COVID policy has stifled output and demand, while antitrust laws from the ruling party have targeted its tech companies. The continued supply chain and labor constraints haven’t helped matters either. Was 2022 always a difficult year with such headwinds?

Maybe, but things are starting to turn around, and it appears that the bulls have returned. Major tailwinds are expected to carry Alibaba into 2023. Let’s look at a few of them.

Positive Outlook

For openers, analysts have identified numerous stocks as poised for a comeback bounce in the coming year. Alibaba is one of the most recent example. On Monday, Morgan Stanley named the e-commerce behemoth their favorite in the tech sector. According to Gary Yu and his team, investors have “underappreciated Alibaba’s leverage to a Chinese consumption rebound.” This is mostly owing to its retail success in areas such as consumer products.

Yu also anticipates an improvement in China’s regulatory environment, which will go a long way toward reversing the selling pressure that has brought shares down as much as 80% from their 2020 highs. But it isn’t all. Founder Jack Ma recently announced his intention to step down as CEO and pass over the reigns to someone else.

With his name now being disassociated with Alibaba, one more risk and possible headwind has been removed.

Along with the bullish outlook, Morgan Stanley reiterated its Outperform rating and set a $150 price objective for Alibaba shares. This indicates a 30% upside from current levels based on where they closed on Wednesday. Shares are already up almost 100% from their lows in October, so this outlook, simply adds gasoline to the belief that a significant recovery rally is in the works.

Additional tailwinds exist in the shape of the zero-COVID policy being reversed, which will finally allow the Chinese economy to recuperate after living in constant dread of a lockdown. This comes after widespread rallies caused the government to cave, which is unusual in China.

Alibaba’s Risk Factors

There are risks, the most visible of which are geopolitical tensions. When compared to a decade ago, the United States and China are no longer on good terms. The conflict in Ukraine and escalating tensions with Taiwan have not helped the relationship.

This has filtered down to corporations, with the United States refusing to transfer semiconductor chips to China for fear that they may be used against them in the future. Chinese retaliation is not ruled out and would almost certainly aggravate the situation.

Furthermore, the delisting risk that has dogged Alibaba and its counterparts in recent years has not materialized as many bears predicted. It still exists, but the longer Alibaba remains on the good side of US auditors, the more likely its shares will become a permanent fixture on the New York Stock Exchange.

Indeed, there was news on this front as recently as the last week of December, when it was reported that numerous US-listed Chinese companies had abandoned intentions to list in Hong Kong. This approach was positioned as their backup option for remaining listed outside of China if the US followed through on the threat of delisting.

Still, this is the beast from the east, Alibaba. While shares have been heavily discounted in recent years, a specter of their former self remains, as indicated by the stock’s doubling in value in less than three months.

For More Financial News, Click Here.

You must be logged in to post a comment Login