Financial News

Robinhood’s Bad Day Got Worse

Published

2 years agoon

By

admin

Many (now ex-) employees at a once high-flying Roinhood had a terrible day just get worse.

What’s the best way to get out from under a multimillion-dollar fine? Employees at the company learned this lesson the hard way.

HOOD – Robinhood (film Troubled brokerage firm Get Robinhood Markets Inc., which attracted Gen Z clients, can’t get a break and is laying off 23% of its workforce.

A multi-million dollar fine was the first step in the process. It was ironic that the problem stemmed from understaffing in one of the company’s most important departments.

CEO Vlad Tenev said the majority of the layoffs will occur for those working in the operations, marketing and program management divisions, according to a blog post.

Earlier in the year, Tenev claimed the company will reduce its employment by 9 percent , but the cut was not sufficient financially.

“This did not go far enough,” he remarked.

“The macroeconomic situation has continued to deteriorate, with inflation reaching 40-year highs and the crypto market collapsing broadly.

This has further curtailed customer trading activity and assets under custody,” Tenev wrote in the blog post.

“In this new context, we are operating with more staffing than appropriate. As CEO, I agreed and assumed responsibility for our aggressive staffing trajectory – this is on me,” he said.

According to the company’s SEC filing, the newest wave of layoffs included 780 employees.

They are being brought in as a result of a company restructuring to create a structure centered on general managers. A restructure and related costs associated with the layoffs are expected to cost Robinhood $30 million to $40 million in cash.

In addition, Aparna Chennapragada, the company’s Chief Product Officer, is stepping down.

Less than a year after its initial public offering, Robinhood has announced that it is laying off hundreds of its employees, just as the meme stock mania has sent shares of companies like GameStop (GME) – Get GameStop Corporation Report and AMC Entertainment (AMC) – Get AMC Entertainment Holdings Inc. Class A Report surging.

According to Tenev, the company’s all-hands meeting on Thursday would include information on the company’s future activities, including an overhaul of its organizational structure. Tenev added. In the future, he claimed, “GMs would acquire broad responsibility for our individual businesses” in a General Manager (GM) structure. We’ll eliminate unnecessary jobs and positions and flatten hierarchies as a result of this modification.

Layoff victims “will be offered the opportunity to remain employed with Robinhood through October 1, 2022 and receive their regular pay, benefits (including equity vesting),” Tenev stated in his email. This includes severance money, payment of COBRA costs for healthcare (including dental/vision), and aid in finding a new work (including an opt-in Robinhood alumni talent directory).”

Growth in ad revenue

In Robinhood’s case, things are only getting worse. At $38 a share when it went public in July 2021, the business earned $318 million in its second quarter, compared to Refinitiv’s estimate of $321 million.

By Refinitiv‘s estimates, the brokerage lost 34 cents per share compared to 37 cents per share.

Revenue from cryptocurrency operations and interest earned by Robinhood pushed total net revenue to $318 million, an increase from the first quarter’s $299 million.

The second quarter of 2021 saw total net revenue of $565 million.

Monthly active users and assets in custody both decreased, according to the data.

Other Concerns

The New York Department of Financial Services has fined Robinhood’s cryptocurrency unit $30 million for allegedly breaking anti-money laundering and cybersecurity standards.

After falling by 76% in the last year, Robinhood’s stock has been hit hard by the fears of high inflation and a possible recession that have weighed heavily on its target demographic, Generation Z, as the stock market has collapsed in response.

After-hours trading saw Robinhood at $9.07. Shortly after coming public, it hit a 52-week high of $85 per share.

Finer People

Following regulatory scrutiny over the last few years, Robinhood agreed to pay a $135 million fine. The brokerage paid a $65 million fine to the Securities and Exchange Commission (SEC) in 2020 and a $70 million fine to the Financial Industry Regulatory Authority (FINRA) in 2021 after it was found to have misled consumers and caused outages.

This slowdown has affected both the cryptocurrency market and the wider financial markets since Robinhood’s start, making it difficult for the company to attract a new generation of investors.

Read More Financial News Here

You may like

Still has momentum.

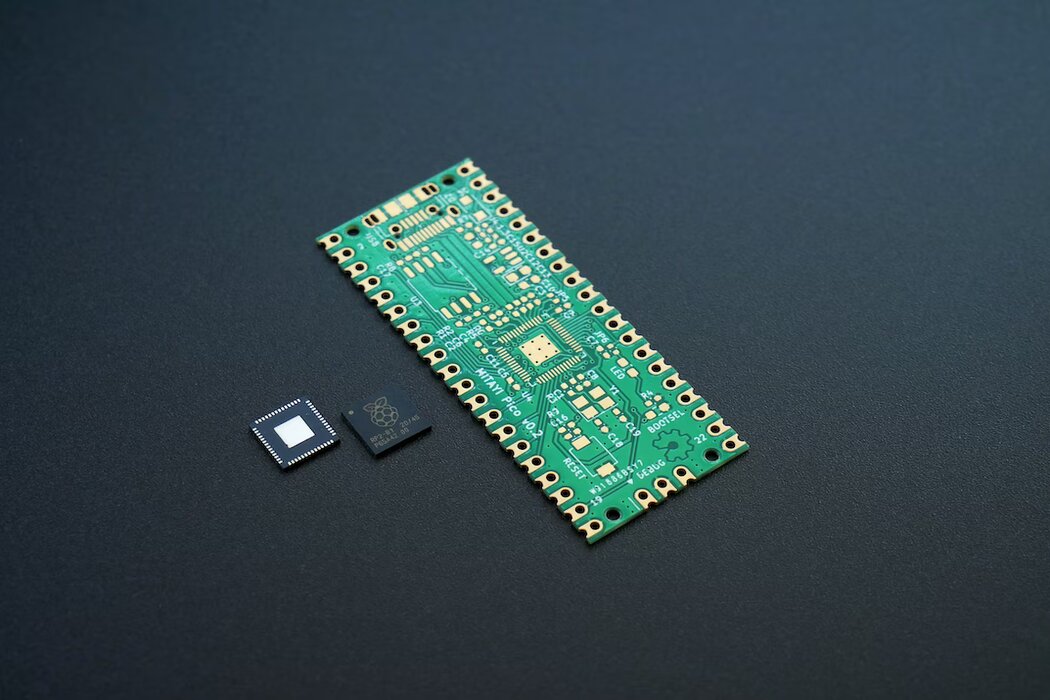

We still issue a buy rating on the Taiwan Semiconductor Manufacturing Company (NYSE: TSM). Our optimistic outlook on TSMC is based on our belief that the firm is better positioned to outperform now, as the semiconductor industry slowly but steadily improves and the company accounts for lower demand in FY2023. TSMC’s fourth-quarter earnings reports were mixed; the company beat profitability projections but fell short on sales. Despite this, the stock climbed roughly 5% when earnings were released. We believe TSM is attempting to counteract reduced end-market demand and inventory corrections, which have hurt sales and lowered forecasts for the upcoming quarter. It is likely that a bottom in TSM and the semi-space in 1H23, followed by a significant recovery in the year’s second half.

We feel that TSM’s stock is a good entry place before the semi-space rebounds. Since our last post on TSMC in late October, the company has already gained 41%, surpassing the SOX index, which has gained only 21%. The graph below depicts our rating history for TSMC.

We urge that investors disregard the market hype surrounding fears of a Chinese invasion of Taiwan and instead focus on the company’s industry-first approach. We believe that TSMC is best positioned to benefit from chip demand once the semiconductor market recovers. Furthermore, we anticipate the company will have the additional power to raise ASP in the second half of 2023. We recommend that investors purchase the stock at current levels in order to benefit from TSM’s rising growth trend in 2023.

The leading pure foundry space allows for ASP gains.

We favor TSMC’s position in the foundry industry, with a 60% market share in 4Q22, and expect it to boost ASP on advanced nodes. We predict TSMC’s market share will expand significantly in 2022 as a result of the increased manufacture of smaller, more sophisticated 5nm wafers. Nanometer size is at the heart of technical developments in the semiconductor industry and, by extension, the world. To be more specific, nanoscale size refers to the distance between transistors on a chip; the smaller the chip, the more advanced and high-performing it is. Our positive outlook on TSM is predicated on our expectation that the company’s growth would be driven by increased adoption of advanced nodes, which are gradually accounting for a larger portion of TSMC’s revenue by technology. TSM has also begun the manufacture of 3nm processors for Apple (AAPL), sustaining Moore’s Law and looking ahead to next-generation technologies.

We anticipate that the rising global adoption of advanced nodes to meet the surging demand for semiconductors will fuel TSMC’s medium- to long-term growth. As a result, we anticipate that TSMC’s position will allow it to improve ASP on advanced nodes in 2H23, owing to the fact that it retains big semi-players as top clients, including Nvidia (NVDA), Advanced Micro Devices (AMD), and AAPL, among others.

Headwinds still persist

TSMC is not immune to the demand slowdown caused by macroeconomic headwinds, as seen by a dip in 1H23 followed by a fast recovery in 2H23. In Thursday’s results call, TSMC CEO C.C. Wei clarified, stating he anticipates 2023 to be a “slight growth year.” We expect TSMC will face inventory corrections in 1H23 as a result of the deteriorating chip-demand environment. We estimate CAPEX reduction in TSMC during 2023, largely as major client AAPL forecasts reduced demand despite weaker consumer spending. TSMC management warned that revenue would fall by roughly 5% in 1Q23, and that annual spending would be reduced. TSMC announced a CAPEX of $36.3B in 2022 and expects CAPEX to be $32-36B in 2023. We are not concerned by TSMC’s lower 1Q23 prediction because we believe the firm is de-risking guidance due to the challenging macro environment.

Despite the macroeconomic challenges, we expect TSMC to continue growing its foundry operations outside of Taiwan in order to mitigate the risks of geographically concentrating manufacturing on the disputed Island. We believe TSMC will play a larger role in the global shift to manufacturing chips in the United States after the CHIPS Act is implemented in 2022. The business intends to more than increase its investment in US foundries to $40 billion by 2026, establishing the US as a hub for advanced chip manufacturing. We estimate that it will take three to four years for US semiconductor companies Intel (INTC) and TSMC to meaningfully produce chips on US territory. Nonetheless, we anticipate that TSMC’s US fabs will be a long-term growth driver.

We predict TSMC stock to rise in the second half of 2019 as the semiconductor sector recovers from a 15-month slump. We anticipate that product introductions and expanded manufacturing of 5nm wafers will help the semiconductor industry recover.

Valuation

We feel TSMC is a value investment since it is selling at a discount to its peer group average. The company is trading at 14.4x C2023 P/E, compared to the peer group average of 21.9x. The company is currently selling at 0.2x EV/C2023 Sales, compared to the peer group average of 4.8x. We believe TSMC stock offers an appealing entry point at current levels, and that investors who purchase the stock now will be well rewarded in 2023.

What should be done with the stock?

We remain optimistic about TSMC. We believe the stock is reacting to lower chip demand in 2023. While we expect the stock to remain volatile in 1H23 as the semiconductor space bottoms, we believe TSMC will benefit from demand tailwinds as the semi-space recovers in 2H23. We also anticipate that TSMC’s growth will be fueled by higher 5nm production and the company’s capacity to boost ASP on advanced nodes in 2H23. We feel the stock offers a good entry point at the current price and propose that investors acquire it.

For More Financial News, Click Here.

Financial News

Solana is Coming Back to Life With a Massive Surge

Published

1 year agoon

January 17, 2023By

admin

It’s a true comeback: the triumphant return of Solana that many experts and industry insiders had written off after the bankruptcy of Sam Bankman-Fried’s FTX on November 11.

They predicted that SOL would not be able to withstand the earthquake symbolized by the collapse of the FTX cryptocurrency exchange and its sister company Alameda Research, a hedge fund that also serves as a trading platform for institutional investors.

In the crypto world, FTX and Alameda were the major corporations representing the Bankman-Fried crypto empire, abbreviated SBF.

“Sam Coin”

Solana did, in fact, have intimate ties to Bankman-Fried. Sol, also known as “Sam coin,” is a token produced by the Solana Blockchain that enables the development of decentralized finance or DeFi projects that provide financial services such as loans, mortgages, financial products, and so on.

The coin is linked to an on-chain crypto exchange dubbed project Serum, which was founded by Bankman-Fried, who resigned on November 11 when his enterprise declared bankruptcy.

Serum is one of the infrastructure’s pillars, as it is the protocol and ecosystem that enables Solana DeFi’s fast speed and low transaction cost. It provides an on-chain central limit order book and matching engine, allowing institutional and retail investors to share liquidity and use strong trading features.

It allows developers the freedom to create trading applications without limitations, as it is not tied to any specific assets. This allows them to utilize Serum’s liquidity and ecosystem advantages in their trading application.

As if to prove Cassandra correct, Sol prices plunged by 73% between the onset of FTX’s issues on November 6 and December 31.

They finished the year at $9.96, down from $32.72 on November 5.

SOL has increased by 79%.

However, as quickly as they fell, so did the prices of Sol. According to monitoring firm CoinGecko, they are up 79% in the last seven days. Sol is currently knocking on the doors of the top ten cryptocurrencies in terms of market value. Before the club’s demise, the token belonged to it.

Prices are currently trading at $23.39, a 134% increase from the beginning of the year.

After a statement of support from Vitalik Buterin, one of the most important voices in the crypto world, sentiment toward Solana shifted.

“Some clever people tell me there is a sincere brilliant developer community in Solana, and now that the nasty opportunistic money people have been washed out, the chain has a bright future,” Buterin, one of the co-founders of Ethereum, the most powerful crypto platform, wrote on Twitter on December 29.

“Hard for me to know from the outside,” he said, “but I hope the neighborhood gets a fair shot to grow.”

Short Squeeze

According to numerous industry sources, the resurrection of SOL is also attributable to an increase in demand for decentralized financial projects. The Solana blockchain enables developers to create decentralized apps, or dApps, at a low cost and provides fast transaction execution.

Its scalability, speed, and affordability make it an appealing alternative for DeFi initiatives that require significant volumes of transactions to be processed rapidly and at a cheap cost.

“While traders are cheering the return of Bitcoin (back over $21,000), and Ethereum (back over $1,550), #Solana is the real star as the weekend begins,” said Santiment, an on-chain analytics business. “$SOL has gained +22% in the last two hours alone, fuelled by liquidated shorts.”

According to Santiment, the significant comeback in Sol prices is the result of a “short squeeze,” which is a fast increase in the price of an asset caused by investors who bet against the product, being forced to purchase it in order to limit their losses.

For More Financial News, Click Here.

After reaching record lows not seen since 2016, 2022 was merciless for Alibaba Group Holding (NYSE: BABA). This comes as no surprise given all of the recent China-related news. A zero-COVID policy has stifled output and demand, while antitrust laws from the ruling party have targeted its tech companies. The continued supply chain and labor constraints haven’t helped matters either. Was 2022 always a difficult year with such headwinds?

Maybe, but things are starting to turn around, and it appears that the bulls have returned. Major tailwinds are expected to carry Alibaba into 2023. Let’s look at a few of them.

Positive Outlook

For openers, analysts have identified numerous stocks as poised for a comeback bounce in the coming year. Alibaba is one of the most recent example. On Monday, Morgan Stanley named the e-commerce behemoth their favorite in the tech sector. According to Gary Yu and his team, investors have “underappreciated Alibaba’s leverage to a Chinese consumption rebound.” This is mostly owing to its retail success in areas such as consumer products.

Yu also anticipates an improvement in China’s regulatory environment, which will go a long way toward reversing the selling pressure that has brought shares down as much as 80% from their 2020 highs. But it isn’t all. Founder Jack Ma recently announced his intention to step down as CEO and pass over the reigns to someone else.

With his name now being disassociated with Alibaba, one more risk and possible headwind has been removed.

Along with the bullish outlook, Morgan Stanley reiterated its Outperform rating and set a $150 price objective for Alibaba shares. This indicates a 30% upside from current levels based on where they closed on Wednesday. Shares are already up almost 100% from their lows in October, so this outlook, simply adds gasoline to the belief that a significant recovery rally is in the works.

Additional tailwinds exist in the shape of the zero-COVID policy being reversed, which will finally allow the Chinese economy to recuperate after living in constant dread of a lockdown. This comes after widespread rallies caused the government to cave, which is unusual in China.

Alibaba’s Risk Factors

There are risks, the most visible of which are geopolitical tensions. When compared to a decade ago, the United States and China are no longer on good terms. The conflict in Ukraine and escalating tensions with Taiwan have not helped the relationship.

This has filtered down to corporations, with the United States refusing to transfer semiconductor chips to China for fear that they may be used against them in the future. Chinese retaliation is not ruled out and would almost certainly aggravate the situation.

Furthermore, the delisting risk that has dogged Alibaba and its counterparts in recent years has not materialized as many bears predicted. It still exists, but the longer Alibaba remains on the good side of US auditors, the more likely its shares will become a permanent fixture on the New York Stock Exchange.

Indeed, there was news on this front as recently as the last week of December, when it was reported that numerous US-listed Chinese companies had abandoned intentions to list in Hong Kong. This approach was positioned as their backup option for remaining listed outside of China if the US followed through on the threat of delisting.

Still, this is the beast from the east, Alibaba. While shares have been heavily discounted in recent years, a specter of their former self remains, as indicated by the stock’s doubling in value in less than three months.

For More Financial News, Click Here.

You must be logged in to post a comment Login