NFT News

Comparing The ICO And NFT Booms

Published

3 years agoon

By

adminICO and cryptocurrency marketplaces are characterized by enduring trends and transitory fads, according to both insiders and outsiders. Some crypto-innovations maintain market dominance and investor mindshare, while others fall quickly and unceremoniously. ICOs and non-fungible tokens are two prominent crypto developments (NFTs).

This post will discuss the Initial Coin Offerings and NFT booms and why NFT markets won’t crash. Topics include:

ICOs’ rise and fall, NFTs’ rise and fall

ICO vs. NFT Booms

ICOs’ rise and fall

ICOs were formerly a blockchain-native way for new protocols to fund their initiatives. ICOs sold project-specific tokens for ether and bitcoin. These coins would be presented as having some utility in the project, giving Initial Coin Offering investors early access to the protocols. ICOs were hailed as a potential to democratize early-stage venture funding because to their minimal entry hurdles. Web 3 founders without access to traditional VC money could benefit from global crypto-focused crowdfunding.

Not all investors bought tokens because they wanted to use the underlying projects. Due to the flywheel effect, which transfers protocol adoption into price rises for the linked token, many investors bought tokens to profit from future price appreciation after the project’s launch. ICOs’ low entry hurdles and unregulated nature made them a prime target for scammers who preyed on inexperienced investors.

ICOs flip the usual process of obtaining finance through VCs or public markets, as this summary shows. Unlike non-crypto enterprises, which are valued based on product-market fit, traction, and scalability, crypto protocols during the Initial Coin Offering bubble were valued solely on hype and token liquidity. ICOs can create market interest with just a whitepaper, generating remarkable prices without market demand. In the non-crypto world, ideas are sometimes worthless without competent execution, yet the ICO market seems to emphasize ideas above execution.

The MasterCoin layer-2 system, now called Omni Layer, raised $500K in BTC in the first formal Initial Coin Offering in July 2013. The Ethereum protocol raised initial funding in July 2014 by exchanging 60M ether for 18.3B BTC. Augur completed the first ERC-20 ICO, raising USD$5.3M for 11,000 REP. ICO market craze didn’t start until early-mid 2017. The market’s enthusiasm for ICOs and the potential upsides of various tokens spurred innumerable companies to multi-million-dollar fundraising and some to multi-billion-dollars. EOS and Telegram Open Network (TON) raised USD$4.1B and USD$1.7B, respectively, after its inaugural runs.

ICOs reached amazing heights in early-stage project fundraising. In June 2017, Initial Coin Offering fundraising for Web 2 startups topped traditional VC funding, with USD$550M raised vs. USD$300M through angel and seed VC investments. In July 2017, ICOs raised $300M while traditional VCs deployed $200M. By the end of this ICO growth era, total funding had topped $1.6B. TokenData reports cumulative ICO funding between January 2017 and July 2018 at USD$17.8B.

The ICO market was riddled with bogus projects that exploited naive investors for financial gain. Exit scams were common, with millions of dollars squandered on ICOs for fake projects. The imaginary developers stole the money and disappeared with their fortune. Kik’s KIN token was the most prominent unregistered security. By passing the Howey Test, many tokens violated US securities laws, exposing the project’s development team to SEC lawsuits (SEC). Ponzi scams and pump-and-dumps were other ICO frauds.

The ICO craze collapsed for several reasons. The macro climate around the crash in 3Q18 was unfavorable and has since been dubbed the ‘Crypto Winter’ A hostile regulatory climate aiming to penalize perceived misdeeds and dissuade further exploitation of naive retail investors also contributed to the crash. The US SEC was forceful in taming the ICO sector. The SEC fined EOS and TON’s development teams USD$24M and USD$18.5M, respectively, and required TON to repay USD$1.2B to its investors.

The 2021 NFT boom began between February and March. After market activity and token valuations cooled, a surge began in 2H21. The greatest evidence of why the market erupted in 2021 may be the record price rises in the wider cryptocurrency market. Bitcoin and ether had year-to-date price growths of 800% and 2,100% at their respective peaks in late 2020 and early 1H21.

Consider the following performance measures to better understand NFT market growth in 2021 and compare it to ICOs:

End-1H21 NFT market size: USD$2.5B. This is up from $13.7M a year ago.

Beeple’s Everydays: The First 5,000 Days sold for USD$69,346,250, the most expensive NFT sale ever.

1Q21 NFT market growth: 2,627%. This increase continued into 2Q21 with 111% QoQ growth, and the market is anticipated to grow further by 3Q21.

NFTs are a blockchain-based innovation similar to ICOs. NFTs were meant to enforce digital scarcity and prove ownership of immaterial assets using blockchain-based tokens. NFTs have not been immune to the same greed-driven and value-destructive practices that bloated the ICO market with scammers. Several collections have been created as money-grabs and blatant copycats of successful NFTs. This has flooded the NFT market with speculative coins without aesthetic integrity or practical functions. Whether NFTs collapse due to another Crypto Winter and greater regulation is unknown.

ICO boom of 2017/18 and NFT boom of 2021 have numerous commonalities. The two manias have innumerable similarities that may give an outside observer the impression that their eventual destiny will be the same.

The absolute volume of funds raised through ICOs has eclipsed that through NFTs, as shown in the graph in the first part of this article. Both supercycles saw tremendous interest and investment surges.

ICO investors likely outnumber NFT investors. In late August, there were 16,000 daily active unique NFT wallets. Monthly, wallets ranged from 24,000 in August 2020 to 280,000 in August 2021. Little data exists on daily or monthly ICO investors, although research suggests the average ICO had 4,700 participants, many of whom spent tiny sums then flipped their tokens before the project’s launch. The average monthly number of ICOs from June 2017 to June 2018 was 98, implying that ICOs averaged over 460,000 monthly investors, more than NFTs.

Despite these commonalities, there are major differences between the two market booms that suggest NFTs will last longer than ICOs. NFTs will replace ICOs as a primary application of blockchain technology and crypto-assets for two reasons:

NFTs are realized, existent assets. ICO investments were speculative bets that the development team’s project objectives would become working products. In many situations, developers can raise millions in ICO fundraising with just a whitepaper. No MVP or market traction was required for a successful ICO. Due to low entry barriers and mindless market behavior, 60% of ICO-backed firms collapsed within four months, leaving investors with worthless tokens. Such speculative future bets were bound to fail. When NFTs are bought, their success doesn’t depend on resource management or team cohesion. Whether an NFT appreciates relies on market dynamics.

NFTs act as a community’s calling card and don’t promise more than that. The NFTs with the highest valuations have benefited their communities the most. This is best illustrated by NFT-based avatars, which gain value as more owners flaunt them online as a sign of crypto-wealth. CryptoPunks and Bored Ape Yacht Club are two avatar projects recently valued in the hundreds of thousands of dollars thanks to their communities’ network effects. In contrast, numerous ICOs were established to raise money for unrealistic projects. Skycoin was a speedier, cheaper Bitcoin alternative. The technology that reportedly enabled the speedy and cheap transfer of Skycoins was never deployed, and the apparent speed of transactions was due to the network being centralized on a single server. Other promised features, such a tumbler method to ensure privacy, were likewise false, and Skycoin’s market fell. Many ICOs didn’t realize their visions.

NFTs have never aimed to evade legal and regulatory systems. NFTs give a mechanism to enforce the scarcity of unique, infinitely replicated digital goods. NFTs can provide sole ownership of digital files and secure ownership transfers by employing blockchain technology. NFTs extend tangible asset ownership, not traditional laws and regulations. ICOs, while altruistic in their goals to enable money access for less-advantaged startups, avoided the legal and financial hurdles of traditional VC or capital markets funding. By using ICOs, founders can avoid IPO filing and registration requirements and VC ownership dilution. ICOs’ backhanded and brazen attempts to undermine regulators led to their demise.

ICO and NFT booms have certain similarities, however it’s doubtful that the NFT industry would fall as badly as ICOs.

The foregoing analogies between NFTs and ICOs don’t indicate the NFT boom will persist forever. NFTs will remain an important part of the crypto markets post-crash, unlike ICOs. Once the token fever settles down and the volume of new initiatives slows, NFT markets will benefit from the clarity and stability of more mature blockchain applications.

Read More NFT News Here

You may like

The seamless exchange of data between several blockchains is known as interoperability. When different blockchains can communicate with one another, they are interoperable. As a result, NFT interoperability entails the easy sharing and trading of NFTs across various blockchain networks and applications.

True blockchain interoperability is still a long way off, and the NFT ecosystem has some issues with it. Although Ethereum remains the most popular blockchain for NFTs, other blockchains like Flow, Cardano, and Solana are all seeing significant developments as the market changes quickly.

Interoperability issues are a major roadblock to a seamless web3 experience. Because they must switch between various chains in order to utilize, monitor, or trade their assets, many NFT holders view the NFT ecosystem’s multichain structure as problematic. For many people, comprehending the technical aspects of crypto wallets and other interfaces is a challenging step in this process.

Blockchain players are especially concerned about interoperability-related problems because they are unable to transfer their in-game NFT assets from one game to another. Players spend a lot of time and money acquiring such assets, yet they are restricted to a small number of blockchain games.

The current state of NFT markets is also not promising. In a perfect world, they could permit NFTs to be listed, bid on, purchased, and sold on any chain. The majority of markets currently only support one particular blockchain. For instance, CNFT is specific to Cardano, while Magic Eden is a market place for Solana NFTs. Some marketplaces, like Rarible, which supports Flow, Tezos, and Polygon, permit the incorporation of NFTs from various blockchains to some extent. However, there are few use cases even in these markets.

We can highlight two different strategies used by modern blockchain developers to boost interoperability.

NFT bridges no. 1

A two-way transaction channel is an NFT bridge. It permits the transfer of an asset between two distinct blockchains by connecting them. NFT bridges use a set of smart contracts to lock the asset that has to be moved on the first chain while minting an identical asset on the second chain and sending it to the wallet address of the original owner. To do this, the NFT owner signs smart contracts to deposit the NFT into the first chain. The identical smart contracts are called on the second chain to mint the duplicate of the original NFT because of these signatures.

The transfer of NFTs from the Ethereum mainnet to another blockchain is the most frequent function that blockchain bridges offer. The NFT bridge provided by Polygon is a well-known illustration. In order to stop hacks and issues with market liquidity, it integrates POS and Plasma security.

Meta blockchain, second

Bridges, which use a two-chain strategy to promote interoperability, go a step further and create the blockchain of blockchains. They provide services for creating a new internet made up of numerous connected blockchains.

By enabling asset exchanges between decentralized blockchains with the help of the IBC (Inter-Blockchain Communication) protocol, Cosmos provides a solution to the NFT interoperability issue.

Another option that makes it possible for blockchain apps to cross various chains is Polkadot. It is creating the XCM language, which will serve as the common language for various blockchains, for this purpose. When it comes to the compatibility of various blockchains, XCM will open up a lot of NFT features, including the ability to stake NFTs across several chains and pay fees using any token.

NFT applications will soon be able to utilize the greatest features of each blockchain thanks to bridges and multichain solutions. As a result, newer goods and services will be produced.

Read More NFT News Here

Digital investment opportunities and the tools needed to discover them, continue to evolve around us. It started with cryptocurrencies through ICOs. The investment portal then evolved with the introduction of NFTs. The marketplace is making further advances enabled by web 3 development. As the evolution of digital investment continues, the necessity to learn new skills and decipher a new stream of information become critical for success. The digital trader has a new frontier and wide open pastures to lay claim to if he or she can plant his or her flag before the other guy or girl. Therefore if you decide to get involved with trading digital assets, it serves you well to accept the fact that you will be at a disadvantage if your access to pertinent information is limited. Knowing that a new NFT dropped a day late can leave you many dollars short. Or missing out on opportunities to see undervalued items instantly leaves you at an obvious disadvantage. Especially when your peers have access to that same information before you have access to it. It’s very difficult to compete in the digital arena if you’re not well informed.

NFT tools continue to evolve

As the digital marketplace evolves more and more entrepreneurs have developed high tech picks and shovels. Lessons from history have proven that those that sell the shovels most often earn more than those that do the digging. It has been discussed in previous blog posts what type of information is needed to create optimal trading opportunities. The expense of purchasing these digital applications has also been discussed. However there are platforms that provide access to timely information for free. Today we will look into the digital Swiss army knives that are available to the 21st century digital trader.

Mint scanners are extremely useful for the NFT collector.

Mint scanners aid you in obtaining information about upcoming drops that you may miss, as you build your twitter base. This tool scans the blockchain for mints. That info is then organized by the trading volume, and alerts can be sent to you. One of the more popular NFT mint scanners is whatsminting.live. Whatsminting.live gives you access to NFTs that are being minted, and the gas costs associated with the mint. Having knowledge about gas costs is helpful because it can help you to understand if the mint is being promoted or naturally occurring within the market. This tool gives you up to the minute information, real time. That’s as close as if you were minting an item yourself. If you choose not to stay fascinated by their website all day, you can monitor their Discord channel for alerts that inform you about what NFTs are trending. The Discord channel is named “Last Minute.”

A wallet scanner is also a useful tool to help you find out what new projects are hot in the NFT space.

It’s known that certain influencers will get information about upcoming projects before the general public. Therefore monitoring the wallets of these influencers to see what NFT project they are buying can lead you to the same well of wealth potential that they have interest in. It must be said that following a particular collector blindly and buying what they do may not be the best strategy. Although if you see 2 or three high profile collectors buying into the same NFT project. That project may have potential for gainful trading opportunities. Monitoring high profile wallets can also provide information to you before the general public. Icy.tools is a helpful free option to monitor digital wallets. You can navigate to their alerts page, provide the addresses of the wallets you wish to track. This will enable you to receive alerts every time they buy something. You can even forward those alerts to your Discord channel.

We will continue to keep you up to date with the latest tools for the NFT collector. These tools are continually evolving so stay tuned for more help in acquiring the equipment you need to give you the best chances for success within the NFT markets.

Read More NFT News Here

NFT News

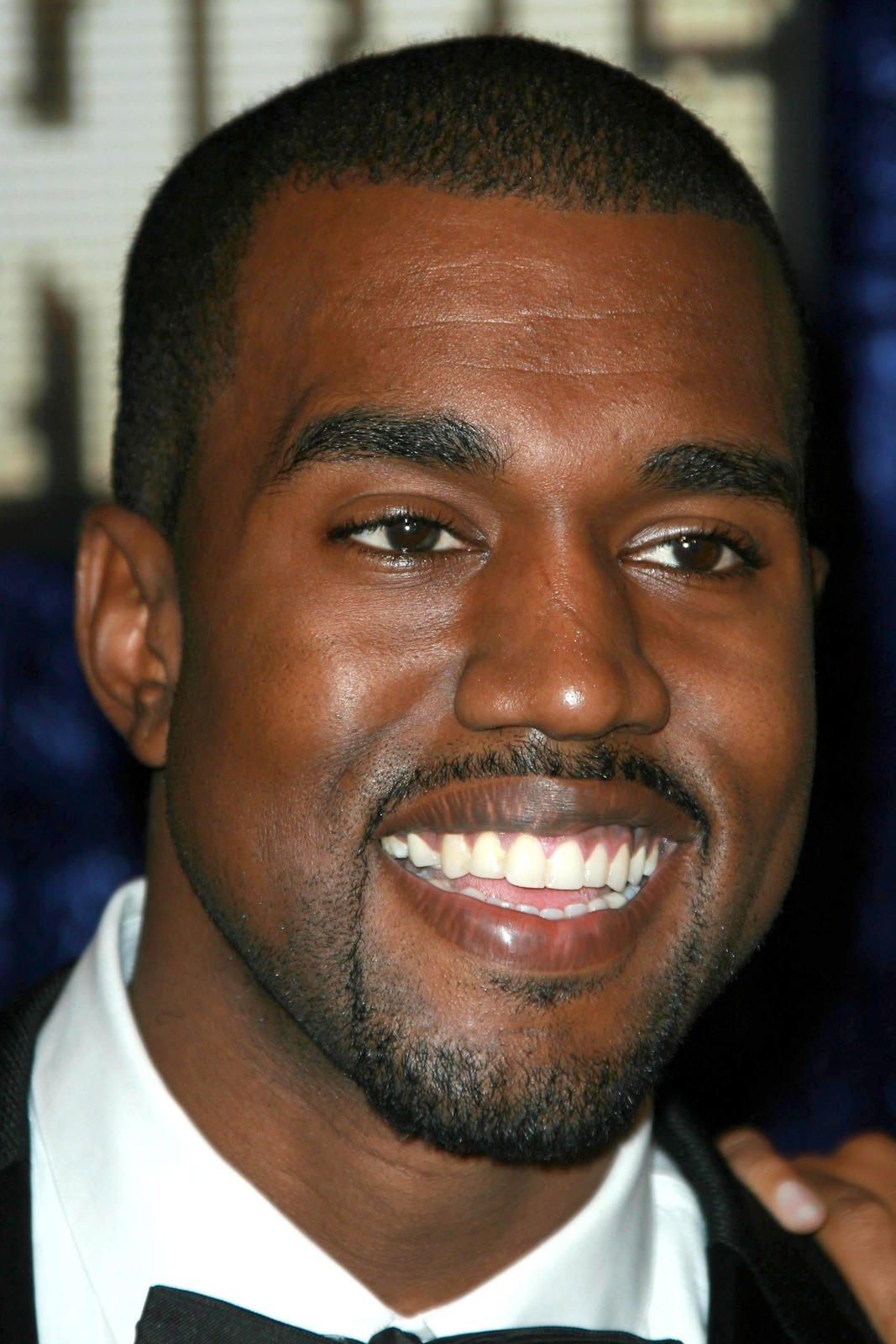

The Robot Face Backpack By Kanye West Sold For 50 ETH!

Published

3 years agoon

September 6, 2022By

admin

Elon.Space, the innovative and cutting-edge NFT initiative, has made an unexpected acquisition by buying Kanye West’s renowned “Robot Face” Goyard backpack. There is a twist in this recent sale of $100,000 (50 ETH), which is a rare investment for a brand-new NFT project. Everyone who purchases an Elon.Space NFT from the next mint will instantly be entered into a drawing to win the renowned Goyard backpack. Since there are only 420 of these special NFTs, holders will have a great chance of winning!

Superstar singer Kanye West commissioned and bought a 1/1 backpack from the ultra-luxury clothing line Goyard during Paris Fashion Week in 2010. In actuality, this was the company’s first backpack in its 1853-old history.

Kanye West at this time is represented by the backpack itself. He was the most popular musician in the world in 2010, and he was starting to use his inventiveness to transform the fashion business. The three front pockets, the zippers, and the renowned Goyard Chevron pattern are just a few of its distinctive features.

The name “robot face” refers to how much the backpack resembles a face. On the lower right, Kanye left his mark in the form of a painted K and star insignia.

The Kanye West Robot Backpack is incredibly important in the fashion industry because it is a unique and innovative piece by Goyard. The French trunk and leather goods manufacturer Goyard is renowned for its secrecy and exclusivity. They actually don’t have an online store, and only 35 stores worldwide are allowed to sell their products.

In 2021, the 1/1 Goyard backpack made a comeback and went on sale for $55,000. Justin Reed, a luxury consignor, later sold it to the Elon.Space group for $100,000. (50 ETH). “It was a pleasure to post this 1 of 1 piece for sale, and I am more than glad to see it go towards an exciting initiative like Elon.Space,” Reed remarked in reference to the transaction.

Why, therefore, has this new NFT project chosen to acquire such a noteworthy item of fashion history? Elon.Space claims that it is due to Kanye’s brilliance, which is consistent with how they see their brand.

Kanye is a creative genius who perfectly complements Elon’s ethos. According to Space, This was the product we were looking for because it embodied an iconic moment and related to the project. We knew we had to text Justin right away to order it as soon as he posted it.

All 420 NFT holders who pre-order the forthcoming mint of the Elon.Space NFT collection will be eligible to win a Kanye West Robot Face bag. Additionally, there will be a giveaway of other tangible goods. These include clothing, candles, and many other things.

The creators of Elon.Space used Elon Musk as well as the “meme culture” that surrounds the billionaire as inspiration for their first project.

Elon.Space will manufacture distinctive “phygital” products by fusing memes, fashion, and cutting-edge technology. One of the motives behind their purchasing of the Kanye West backpack is this.

Elon is the most approachable person in the Web3 and NFT arena because of his meme culture. He enjoys trolling, loves DOGE, and is heading to space. Elon.Space founder: “His personality is the prototypical Web3 millionaire.

The first NFT collection, which consists of 420 randomly selected and digitally generated photos, will be connected to tangible goods related to Elon Musk’s genuine commercial endeavors.

Sometime in September will see the Elon.Space NFT mint. There is a pre-mint procedure with a public mint and allowlist. Prior to the presentation, the team is also giving away “Mars & Beyond” candles in addition to the Kanye West backpack. To learn more, follow the official Elon.Space Twitter account.

Read More NFT News Here

You must be logged in to post a comment Login